- April 19, 2022

- Posted by: TechTAR Solutions

- Category: Power BI

The Product

Financial Institutions have invested considerably in their anti-money laundering and risk management procedures in order to comply with regulatory regulations, yet they are still facing significant penalties for non-compliance.

AML Analytics fills in the gaps between AML stakeholder requirements, allowing financial institutions to quickly respond to changing regulatory requirements while lowering AML costs. It’s a compilation of fresh ideas for undiscovered AML use cases that satisfy stakeholders’ needs while reducing AML expenses.

Our Thoughts Behind the Product

We have undertaken a study of existing AML adoption and identified a number of gaps and possibilities that can assist financial institutions to improve their AML effectiveness and efficiency.

AML Analytical is a data platform with advanced analytics capabilities. We built it with Microsoft Power BI.

With the AML Analytics, we want to change the focus of financial institutions from the firm centric to the purpose centric

Click here to view the AML Analytics

NOTE: Sample Data is used for the purpose of these reports.

Features

We have a focus on the following areas in the development,

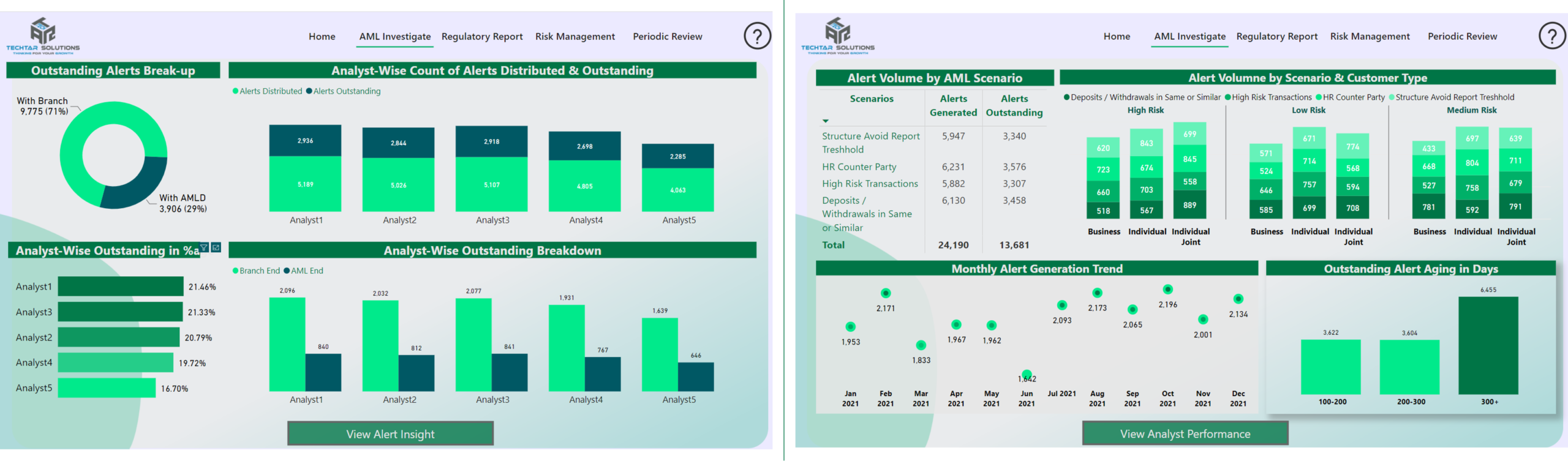

1. AML investigate

A significant portion of AML costs is spent on systems that combine basic and more complex rules and scenarios to determine whether a customer or transaction is suspicious.

To combat money laundering, timely closing of such alerts is critical for informing authorities about such customers or transactions.

The Alerts Insights module will deliver

- A daily summary of analyst performance through KPI & KRI reporting

- Compare the number of alerts generated with the rules enforced in the system.

This module is divided into two sections, one for the AML ALERTS VOLUME and the other for ANALYST PERFORMANCE tracking. Toggle between modules by clicking the bottom button.

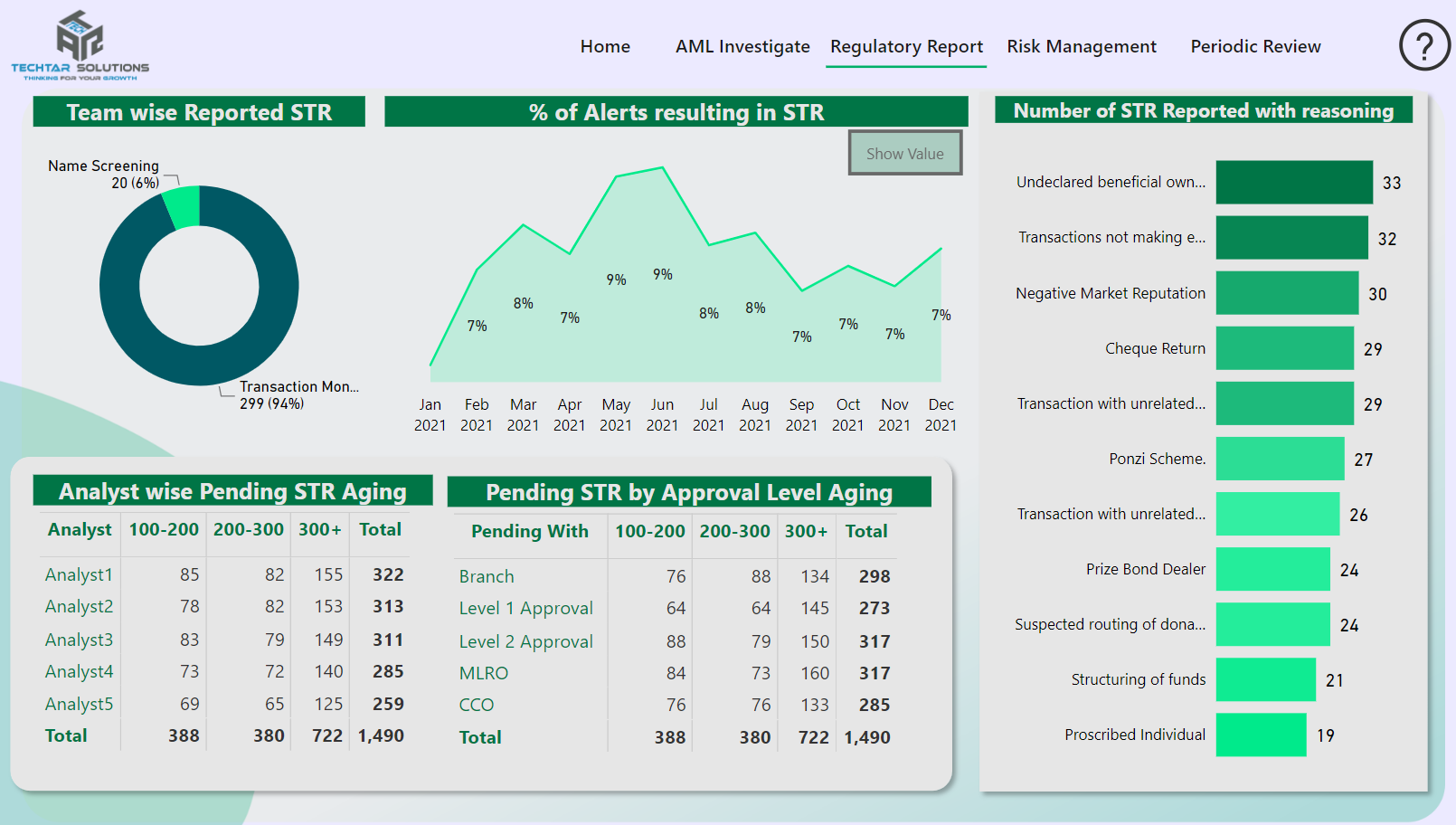

2. Regulatory Report

True positive notifications are escalated to authorities via the Suspicious Transaction Report (STR) or Suspicious Activity Report (SAR). Authorities also set the reporting deadline, and failure to comply might result in serious consequences for the business.

The STR Records module provides an overview of the

- Number of STR Submitted

- Purpose of STR

- Pending STR Aging according to Analyst and Level of Authorities

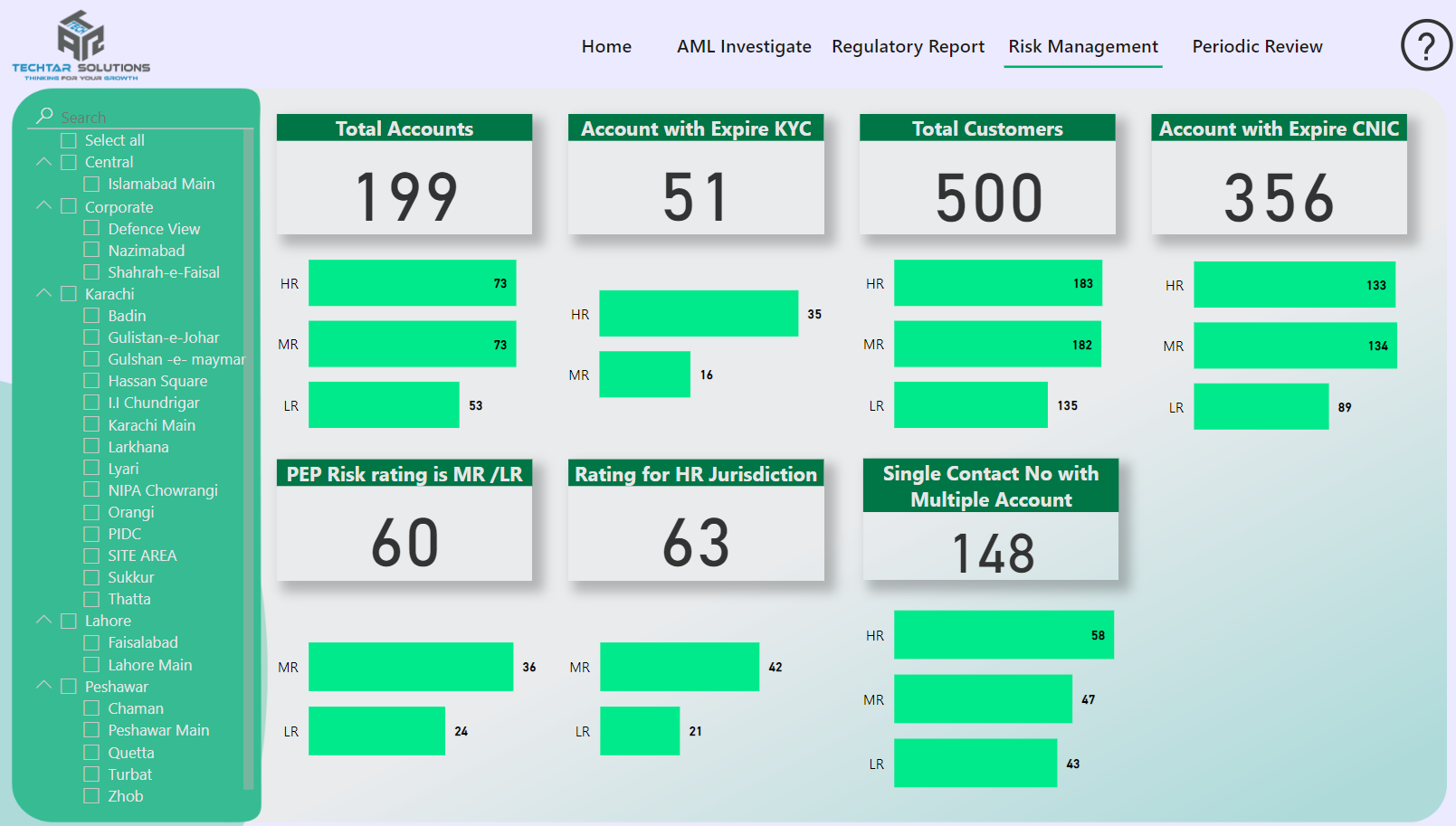

3. Risk Management

Know Your Customer – KYC is the most important document for assessing customer risk. However, the review process usually lasts between one and three years.

Through the Risk Management module, you can connect your data on a regular basis to identify KYC issues.

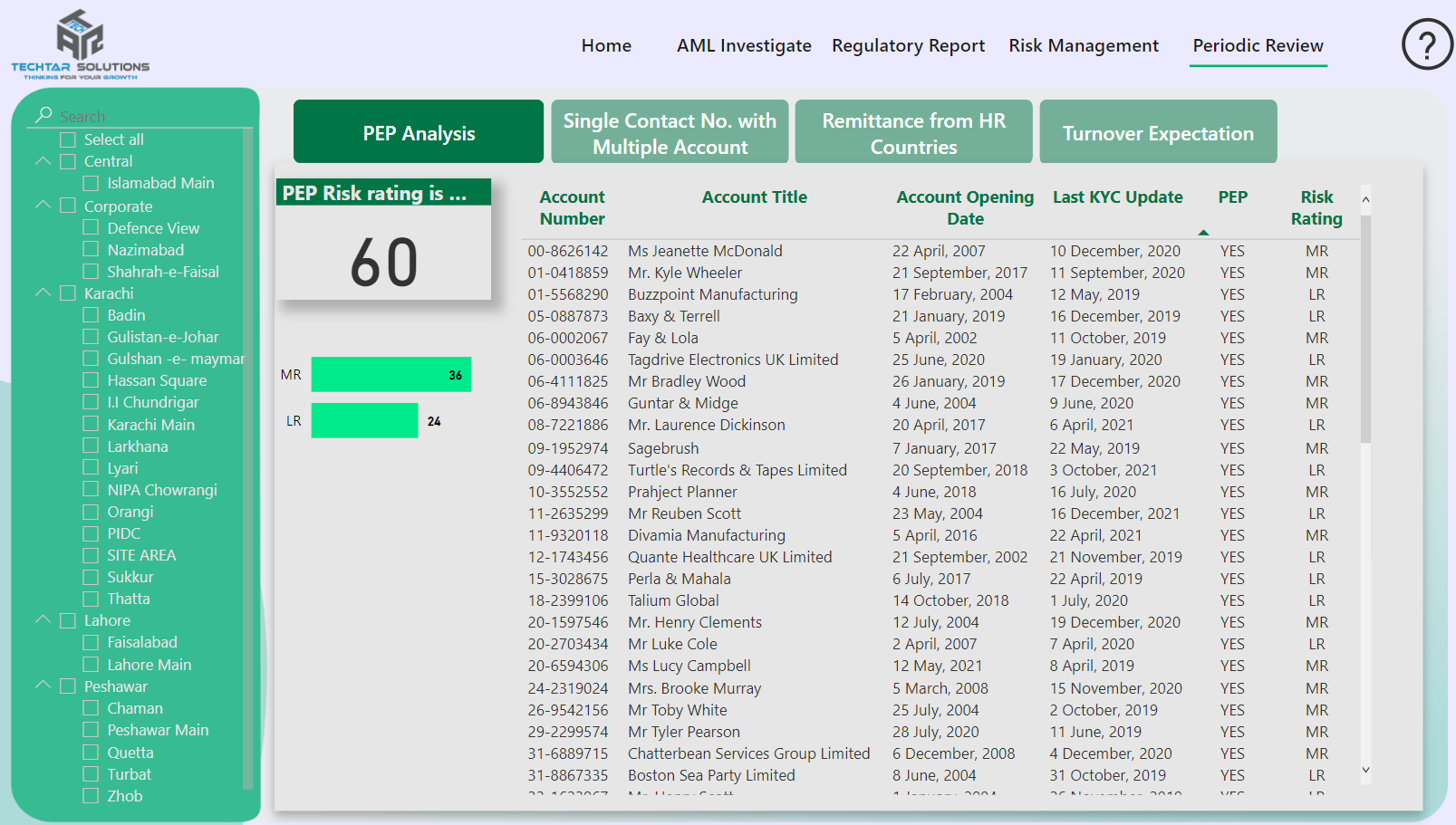

4. Periodic Review

This module is the extension of the Risk Management Module. This module allows you to send a thorough report of risk factors to your Regional/Zone/Area/Branch. This module helps you save time by automating email sending.

Each of your Regional/Zone/Area/Branch employees can log in, examine their KPI, and download the report in CSV/Excel format.

A Power BI Service license is required to use this module.

Four reports are now shared, and the objective of each report may be seen by hovering the mouse over ![]() at the right top of each table.

at the right top of each table.

The reports displayed are examples of our concepts; you can engage our consultants to create a custom AML dashboard. You may also train your employees by bringing our training in-house.